The government should only act to protect the individual rights of its citizens. If a business is engaging in practices that are in violation of these rights, then it should get involved.

It should not attempt social engineering by giving certain businesses advantages over others because it is politically or socially expedient.

The government's problem is it acts for itself more often than for its citizens. The government has no rights, it has only duties, and it is failing those duties pretty spectacularly right now.

I'm just as upset about the current "privatize profits, socialize losses" behavior as anyone, but I also don't believe we should punish success to elevate failure either. This general cloud of hatred for the rich smacks of wealth envy. "Because I'm not rich, nobody else should be either."

It's very worrisome that this sentiment is so prevalent. Not to mention businesses who are assailed by heavy-handed regulation and draconian tax law will simply pick up and relocate elsewhere, further damaging the economy.

Quote:

Originally Posted by VicAjax /img/forum/go_quote.gif

absolutely. it's possible, however, that this would not have happened if banks weren't allowed to be publicly traded. the addition of shareholder pressure to show year-to-year revenue growth and push stock prices higher is a strong motivator to make riskier and riskier moves.

and if you think about it, buying stock in a publicly traded bank isn't investing... it's meta-investing. once upon a time, public companies (funded by banks) pretty much produced hard goods, whereas banks don't produce anything except (if they're lucky and good) more money.

and then, when banks start selling investment packages based on nothing more than real estate debt, you add yet another layer, and so it becomes meta-meta investing.

it's a ridiculous, unsustainable shell game.

|

Precisely. Goes back to "something from nothing."

Were the government not involved, were there no humongous inflation-causing bailout, these banks would be learning the hard way. But thanks to that, they're sitting pretty and taking $500,000 vacations.

"ur doing it wrong."

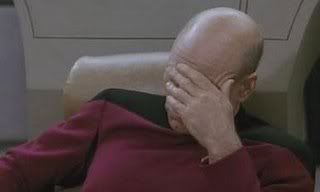

Damn I need that Jean Luc-Picard headache jpeg for these banks. For reals.