Quote:

Originally Posted by Stephonovich /img/forum/go_quote.gif

My initial thought is that I might want to buy a house in a year or so, after the market has maybe settled down a little. Not so sure about that anymore. The economy seems shaky at best, and the sub-prime foreclosurers haven't seem to hit CT yet. I'm not sure if people here are wealthier/not stupid, or it's just more delayed. In any case, I really don't want to lock myself into a situation that rocky.

|

It's delayed a bit since CT didn't have as much of a housing bubble as some other areas, plus it's a wealthy old money state. However, keep in mind that banks have drastically tightened up their lending since the start of the subprime and Alt-A mess, the exotic interest only ARM's and other such mortgages are gone, we are now back to the historic 10, 15, and 30 year fixed mortgage with 20% down and 35%-40% debt to income ratio. In other words, depending on what the interest rate is, if the price of the home is worth more than 3.5 times or so of your household income you can't afford it.

Wait for prices to fall to around that level before buying. If you buy earlier you're just blowing your money since if any similar homes in a 1-2 mile radius default & foreclose the banks will dump them back on the market at 25-50% off, and that will instantly revalue every similar home in the area to the bank auction price. In which case you've just lost all the equity in your home and your own mortgage is now upside-down, you now owe more, far more than your home is worth.

Quote:

| My wife has about $4K in stocks (Duke and Spectra energy) that she was given by her grandmother. Her grandmother, who with her late husband held large numbers of Duke and Spectra, thinks we should sell the Duke (we were going to re-invest it in VFINX, Vanguard's S&P 500-esque Index Fund) and keep the Spectra. Now, Spectra is entirely natural gas, from what I can see, whereas Duke is more diversified. I may be a bit biased, being a nuclear operator, but I like the future of nuclear power. Quite a bit. So in my mind, the Duke would be better to keep. Any thoughts on this? |

The future of nuclear power is still up in the air at the moment, I believe new site permits have been issued but construction, if any, is still uncertain and well off in the future. Natural gas will be quite profitable in the near future for the same reason oil is today; it's a finite resource which we're burning up and there's no real substitutes on the horizon. Furthermore, an increasing percentage of our generating stations now use natural gas, consumption is going up and will soon outstrip supply, I don't think I have to tell you what that's going to do to the price.

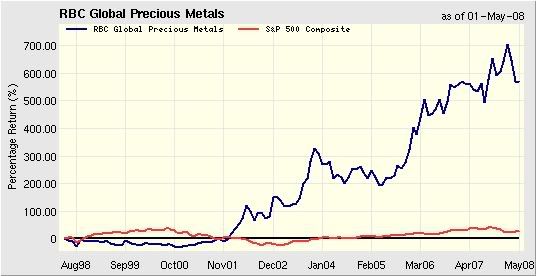

As for index funds, yeah, good luck. Look at the S&P 500, DOW, Russell, TSX, and every other market index, the PE ratios are absurd and unsustainable, many companies are moving

against the fundamentals (ie. XYZ inc. misses earnings estimate, loses $10 billion in a quarter, lays off half its workers, and somehow its shares go up 30%), and they're getting hit with bad debt all over the place.

This cannot continue, eventually the market will come to its senses and crash every single index through the floor. When the Bonds market completely locks up and suffers a dislocution, that's the panic signal for the markets to crash. The bonds market is in the process of locking up as we speak.

Quote:

| Also, what about short-term investments? Are they really just an educated crapshoot, or can you actually make decent returns on a regular basis? |

If you really know what you're doing and you have enough money & time to play the market, then you can make a decent return. If not, it's a very quick way to go broke given the volatility of today's markets.

Hmm...good options though. I'm hoping (that's all you can do right) that my kid gets a scholarship like I did. The difference between me and my kid is, he's going to take it, and not join the military instead like me, lol.

Hmm...good options though. I'm hoping (that's all you can do right) that my kid gets a scholarship like I did. The difference between me and my kid is, he's going to take it, and not join the military instead like me, lol.